As expected, the U.S. Federal Reserve boosted its overnight lending rate by .75% on Wednesday in an effort to bring down stubbornly high inflation.

The increase was big news, but longer-term interest rates had already risen sharply before the Fed announcement. That happened last week when the August inflation numbers were released, showing core U.S. inflation (stripping out volatile food and energy components) had accelerated to 6.3% on a year-over-year basis.

The bond market fell sharply on that news, and since bond prices move inversely to bond yields (the effective interest rate paid by bonds), the drop in bond prices meant higher interest rates. In turn, those higher rates lifted borrowing costs for mortgages, car loans and other types of debt.

So, what is the relationship between central bank rate decisions and the interest paid by you and me (or earned on our savings)?

Central banks control short-term interest rates through what’s known as their policy rate. It’s the rate at which banks borrow and lend to each other overnight.

By setting the policy rate, central banks indirectly influence rates charged to consumers. For example, commercial banks typically raise the prime lending rate they charge clients immediately after an increase by the central bank. The commercial banks’ prime lending rate is the basis for the majority of their floating rate loans (e.g. personal or home equity lines of credit.)

However, long-term interest rates aren’t controlled by central banks but rather by the decisions of a multitude of investors trading in the bond market every day. The market constantly digests new information and prices it into bond yields, whereas the Fed only changes their policy rate a handful of times a year.

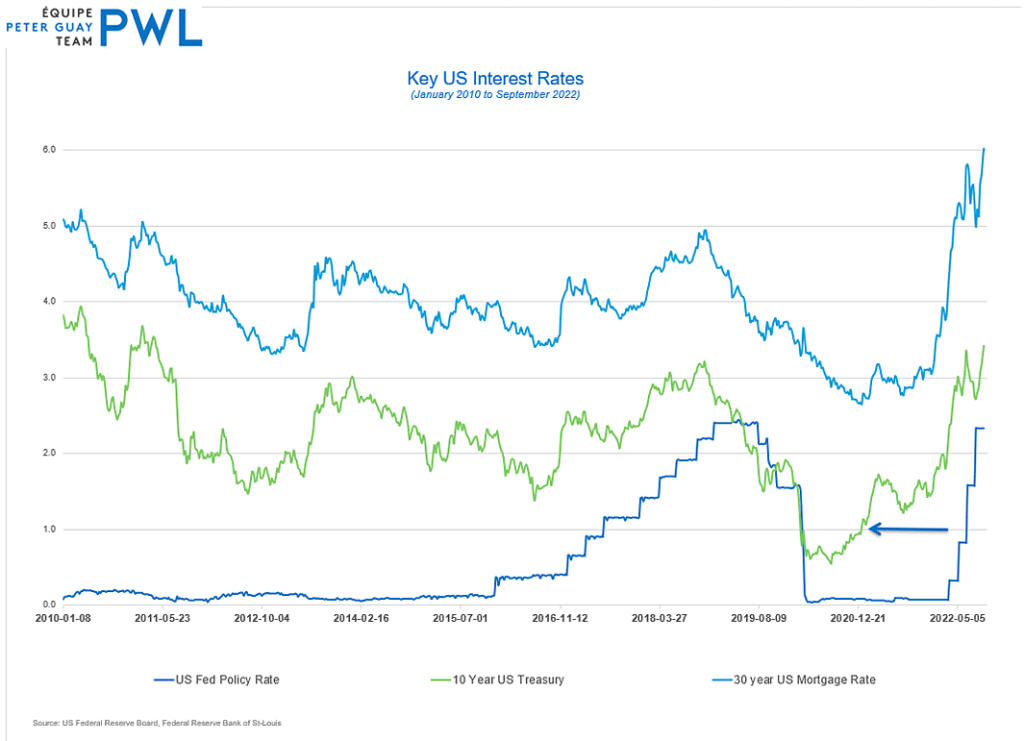

As you can see from the graph below, there is quite a bit of variance between interest rates for 30-year mortgages and the 10-year U.S. Treasury (a widely tracked benchmark government bond) on one hand, and the Fed Overnight Rate on the other.

It shows that the cost of borrowing is much more dependent on the market than it is on interest rate decisions by the Federal Reserve.

For example, from November 2020 to April 2021 the Fed Overnight Rate remained at rock-bottom levels, but longer-term rates rose as anti-COVID vaccines became available and the economy reopened.

At the same time, the Biden administration’s infrastructure plan had just been released with a whopping US$2.3 trillion price tag, leading investors to demand higher interest rates to lend the U.S. government so much money.

All of this demonstrates just how difficult it is to forecast interest rates. You may be able to correctly predict central bank rate decisions, but you also have to anticipate how the market is going to move at any given time. There’s no evidence that anyone can do that consistently.

The conclusion is that the future course of interest rates, like other market movements, is inherently unpredictable. Last month, rates were down from their recent peak after a better-than-expected inflation reading. This month, they’re up after inflation came in hotter than expected.

Timing interest rate movements is no easier than timing the movements of the stock market. Over time markets reward those who take a long-term perspective and stick to their investment plan with discipline through thick and thin.